How To Calculate Property Tax With Mill Rate . Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. Do you remember when you were in school and you were working. Use our property tax calculator to work out how much property tax you have to pay. It represents the amount of tax per dollar of the. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Then divide that figure by the. It represents a dollar per. Use the property tax calculator to estimate your real estate taxes! You can calculate your property tax from 5 preceding. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes. Mill rates are used to calculate the amount of property tax payable on a property.

from tsmfinancialmodels.com

To calculate the effective tax rate, first, use the mill rate to determine the tax payment. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes. You can calculate your property tax from 5 preceding. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. It represents the amount of tax per dollar of the. Then divide that figure by the. Mill rates are used to calculate the amount of property tax payable on a property. Use the property tax calculator to estimate your real estate taxes! Do you remember when you were in school and you were working.

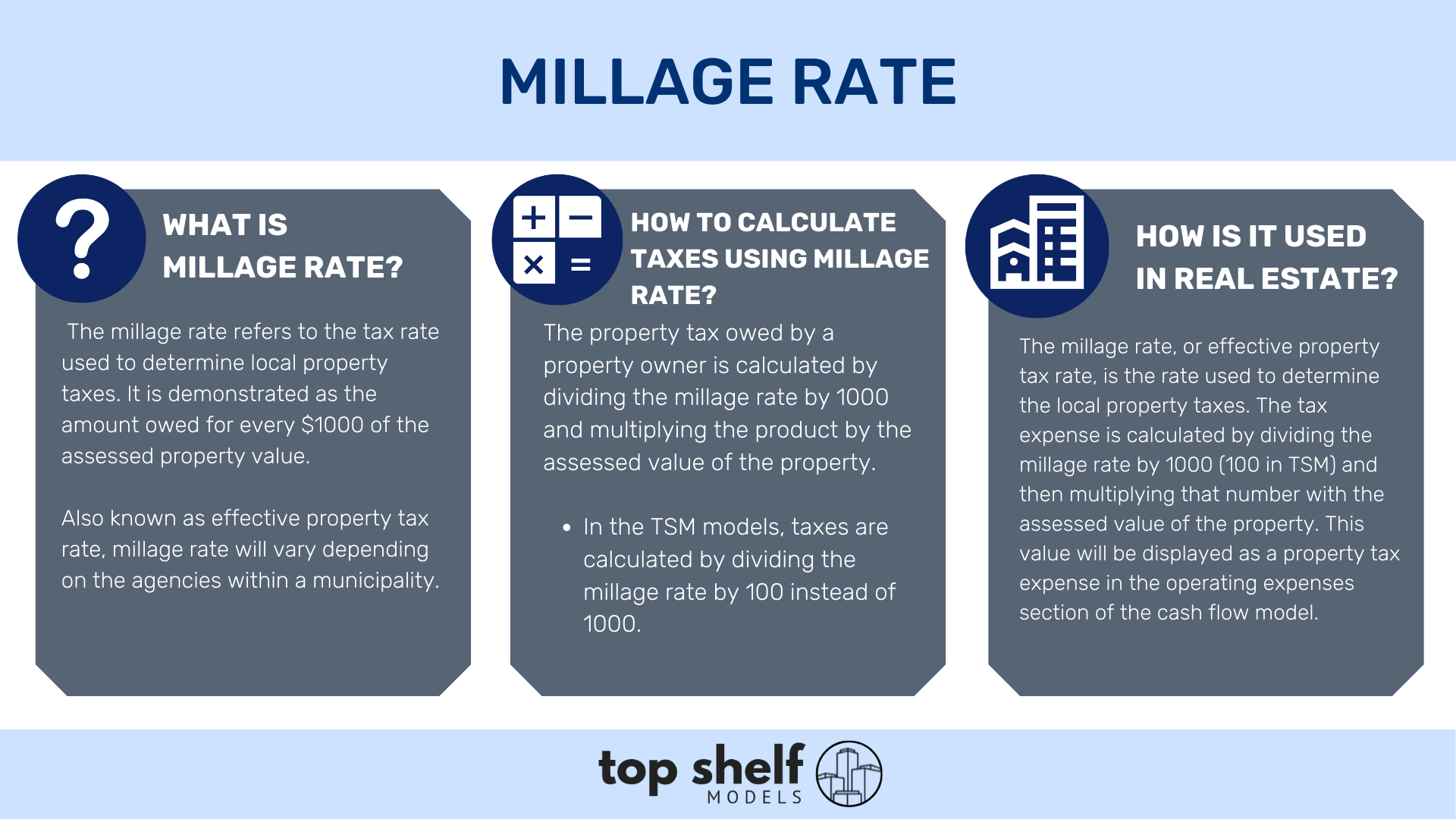

Millage Rate in Real Estate Modeling — Top Shelf® Models

How To Calculate Property Tax With Mill Rate It represents the amount of tax per dollar of the. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Use the property tax calculator to estimate your real estate taxes! Then divide that figure by the. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. It represents a dollar per. It represents the amount of tax per dollar of the. Mill rates are used to calculate the amount of property tax payable on a property. You can calculate your property tax from 5 preceding. Do you remember when you were in school and you were working. Use our property tax calculator to work out how much property tax you have to pay. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes.

From de.slideshare.net

Use Online Property Tax Calculator for Estimating Value of Property T… How To Calculate Property Tax With Mill Rate Use our property tax calculator to work out how much property tax you have to pay. It represents a dollar per. It represents the amount of tax per dollar of the. Then divide that figure by the. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. You can calculate your property tax from 5. How To Calculate Property Tax With Mill Rate.

From www.investopedia.com

What Is a Mill Rate, and How Are Property Taxes Calculated? How To Calculate Property Tax With Mill Rate Use the property tax calculator to estimate your real estate taxes! Then divide that figure by the. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. It represents the amount of tax per dollar of the. Do you remember when you were in school and you were working. To. How To Calculate Property Tax With Mill Rate.

From www.oakcreekwi.gov

Mill Rate Information City of Oak Creek How To Calculate Property Tax With Mill Rate Then divide that figure by the. Do you remember when you were in school and you were working. Mill rates are used to calculate the amount of property tax payable on a property. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Use the property tax calculator to estimate. How To Calculate Property Tax With Mill Rate.

From annarborchronicle.com

The Ann Arbor Chronicle Does It Take a Millage? How To Calculate Property Tax With Mill Rate Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. You can calculate your property tax from 5 preceding. It represents a dollar per. Then divide that figure by the. Use the property tax calculator to estimate your real estate taxes! Understanding how to calculate property taxes using the mill. How To Calculate Property Tax With Mill Rate.

From oceanviewblog.wordpress.com

2016 Municipal Property Tax Overview, Amounts & Mill Rate Chart How To Calculate Property Tax With Mill Rate You can calculate your property tax from 5 preceding. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. Use our property tax calculator to work out how much property tax you have to. How To Calculate Property Tax With Mill Rate.

From www.thetechedvocate.org

How to calculate property tax with mill rate The Tech Edvocate How To Calculate Property Tax With Mill Rate Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. Do you remember when you were in school and you were working. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. You can calculate your property tax from 5 preceding. Use our property tax calculator to work out. How To Calculate Property Tax With Mill Rate.

From www.pinterest.com

How to Calculate Your Property's Assessed Value Property tax, Estate How To Calculate Property Tax With Mill Rate Use the property tax calculator to estimate your real estate taxes! Then divide that figure by the. It represents a dollar per. Use our property tax calculator to work out how much property tax you have to pay. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property. How To Calculate Property Tax With Mill Rate.

From waltonpa.com

Millage Rates Walton County Property Appraiser How To Calculate Property Tax With Mill Rate Then divide that figure by the. It represents a dollar per. Use our property tax calculator to work out how much property tax you have to pay. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Mill rates are used to calculate the amount of property tax payable on. How To Calculate Property Tax With Mill Rate.

From www.ownerly.com

How to Calculate Property Tax Ownerly How To Calculate Property Tax With Mill Rate Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. Use our property tax calculator to work out how much property tax you have to pay. It represents a dollar per. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes. Then. How To Calculate Property Tax With Mill Rate.

From slideplayer.com

Measuring the Tax Increment ppt download How To Calculate Property Tax With Mill Rate You can calculate your property tax from 5 preceding. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. Mill rates are used to calculate the amount of property tax payable on a property. It represents the amount of. How To Calculate Property Tax With Mill Rate.

From www.youtube.com

How to calculate millage rate YouTube How To Calculate Property Tax With Mill Rate It represents a dollar per. Do you remember when you were in school and you were working. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. It represents the amount of tax per dollar of the. Then divide that figure by the. Use the property tax calculator to estimate your real estate taxes!. How To Calculate Property Tax With Mill Rate.

From www.chegg.com

Solved Question 13 of 20 The mill rate of a residential How To Calculate Property Tax With Mill Rate Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Use our property tax calculator to work out how much property tax you have to pay. Then divide that figure by the. To calculate the effective tax rate, first, use the mill rate to determine the tax payment. A millage. How To Calculate Property Tax With Mill Rate.

From vi.fontana.wi.gov

What Is A Mill Rate? Village of Fontana How To Calculate Property Tax With Mill Rate Use our property tax calculator to work out how much property tax you have to pay. It represents a dollar per. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes. Use. How To Calculate Property Tax With Mill Rate.

From www.ownerly.com

How to Calculate Property Tax Ownerly How To Calculate Property Tax With Mill Rate It represents a dollar per. Use our property tax calculator to work out how much property tax you have to pay. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. You can calculate your property tax from 5 preceding. To calculate the effective tax rate, first, use the mill. How To Calculate Property Tax With Mill Rate.

From www.youtube.com

Calculating Property Tax Using Mills YouTube How To Calculate Property Tax With Mill Rate Mill rates are used to calculate the amount of property tax payable on a property. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. It represents the amount of tax per dollar of the. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.. How To Calculate Property Tax With Mill Rate.

From tsmfinancialmodels.com

Millage Rate in Real Estate Modeling — Top Shelf® Models How To Calculate Property Tax With Mill Rate You can calculate your property tax from 5 preceding. It represents a dollar per. Mill rates are used to calculate the amount of property tax payable on a property. Use our property tax calculator to work out how much property tax you have to pay. Use the property tax calculator to estimate your real estate taxes! Then divide that figure. How To Calculate Property Tax With Mill Rate.

From redding2.fyi

What is the Mill Rate? Redding Info 2 How To Calculate Property Tax With Mill Rate It represents a dollar per. Use our property tax calculator to work out how much property tax you have to pay. Then divide that figure by the. It represents the amount of tax per dollar of the. A millage rate is a numerical multiplier attached to the value of a property and is used to calculate the local property taxes.. How To Calculate Property Tax With Mill Rate.

From www.amybergquist.com

Calculating West Hartford Property Taxes for July 2022 to June 2023 How To Calculate Property Tax With Mill Rate Mill rates are used to calculate the amount of property tax payable on a property. Use the property tax calculator to estimate your real estate taxes! It represents a dollar per. Understanding how to calculate property taxes using the mill rate empowers you as a homeowner. You can calculate your property tax from 5 preceding. Annual property tax is calculated. How To Calculate Property Tax With Mill Rate.